Money Lesson 1:

Create a Budget

Want to take control of your money? Everything starts with a budget.

What is a Budget?

A budget is simply a plan for your money — helping you make sure it’s being used in the right places. It compares what you earn with what you spend over a set period—typically a month—so you can see exactly where your money is going.

Once in place, a budget becomes one of your most powerful financial tools. You can track your actual expenditure against your budget each month, helping you to stay on top of your spending, ensuring your money goes where it matters most and highlighting areas where you might be overspending. Spend less on one category? Great—you can redirect that money toward savings, an emergency fund, a big purchase, or investments.

But there is a catch: for your budget to work, you need to be honest with yourself. That means getting a clear picture of both your income and your actual spending habits. The more accurate the numbers, the more useful your budget will be.

All of this might not sound exciting—and yes, it can feel a bit overwhelming at first—but it’s the cornerstone of good money management. It’s what allows everything else—saving, investing, planning for the future—to fall into place. That’s why budgeting is the very first step in our “5 Key Money Lessons.”

Try our free online budget planner

How to build a budget in 6 steps:

There are several ways to create a budget—you could jot it down on paper or in a spreadsheet, use a specific budgeting app, or use our free online budget tool. For the purposes of this guide, we’ll assume you’re either writing it out by hand or using our online budget tool to get started.

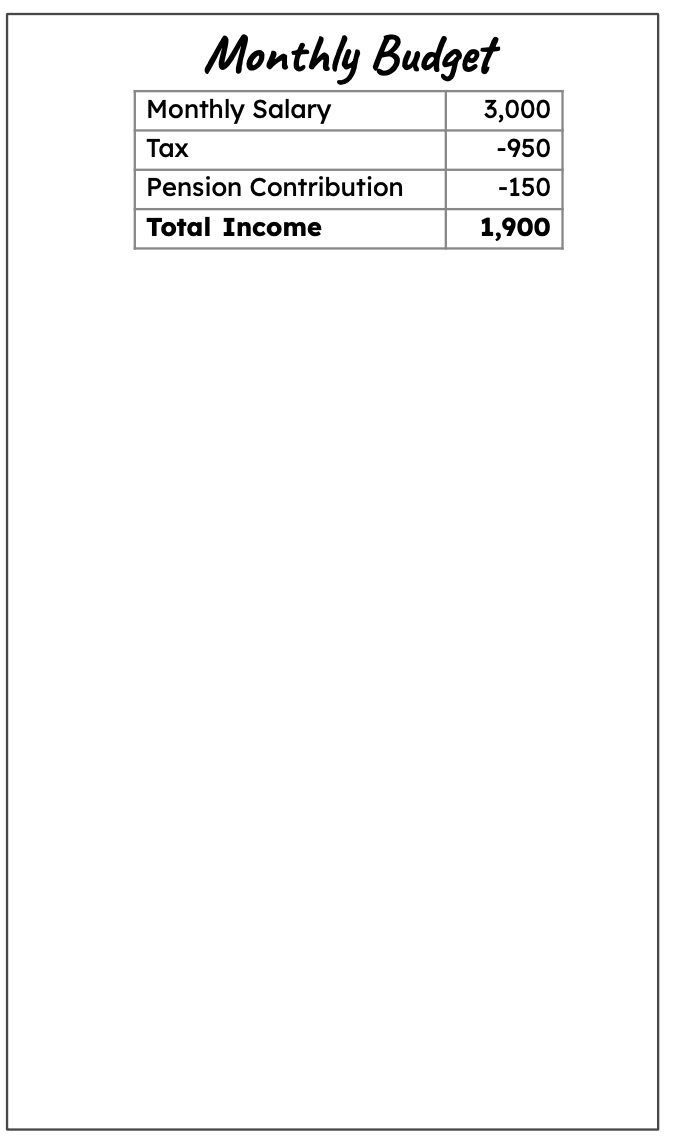

To begin budgeting effectively, the first step is to determine how much money you bring home each month. This is sometimes called your ‘Net Monthly Income’ or ‘Take Home Pay’. This entails calculating your salary after deductions such as taxes, pension contributions, and any other direct payments.

You should include all sources of income such as earnings from a second job, investment returns, pension disbursements, or other benefits you receive.

If you're unsure about how to calculate this number, you can typically find these figures easily accessible on your pay slip from your employer. Or you can use our free online monthly income calculator to work it out for you.

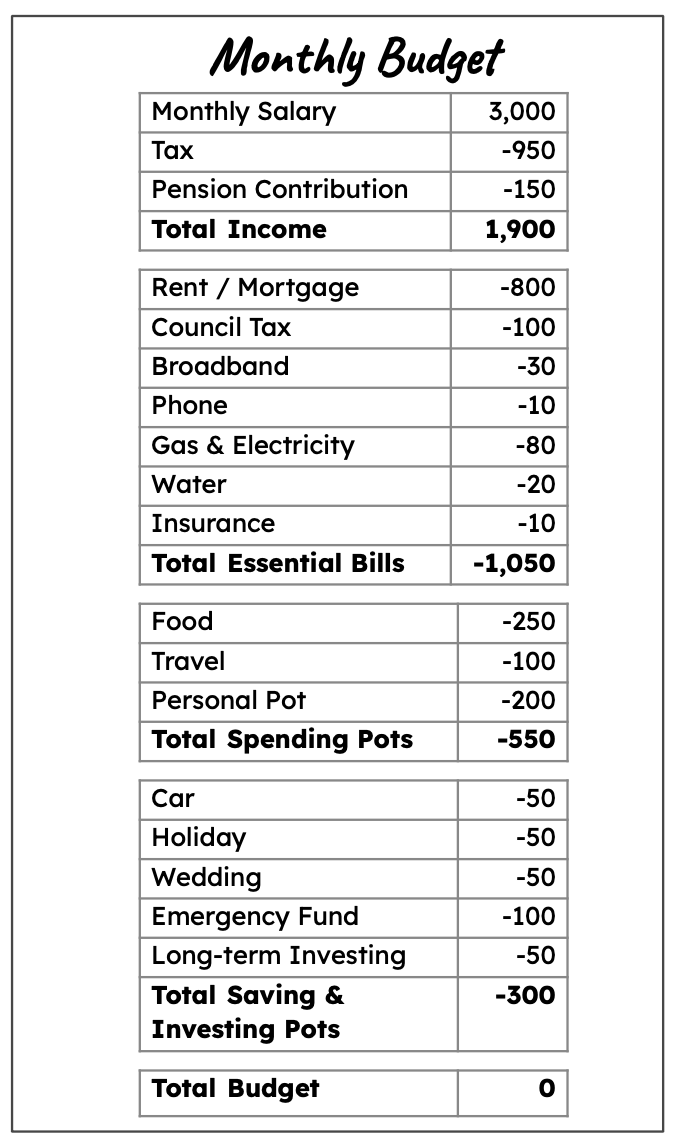

In the provided example, a monthly salary of £3,000 (equivalent to £36,000 annually) is considered, with deductions of £950 for taxes and £150 for pension contributions (5% of salary). Giving a net monthly income of £1,900.

Enter Monthly Income

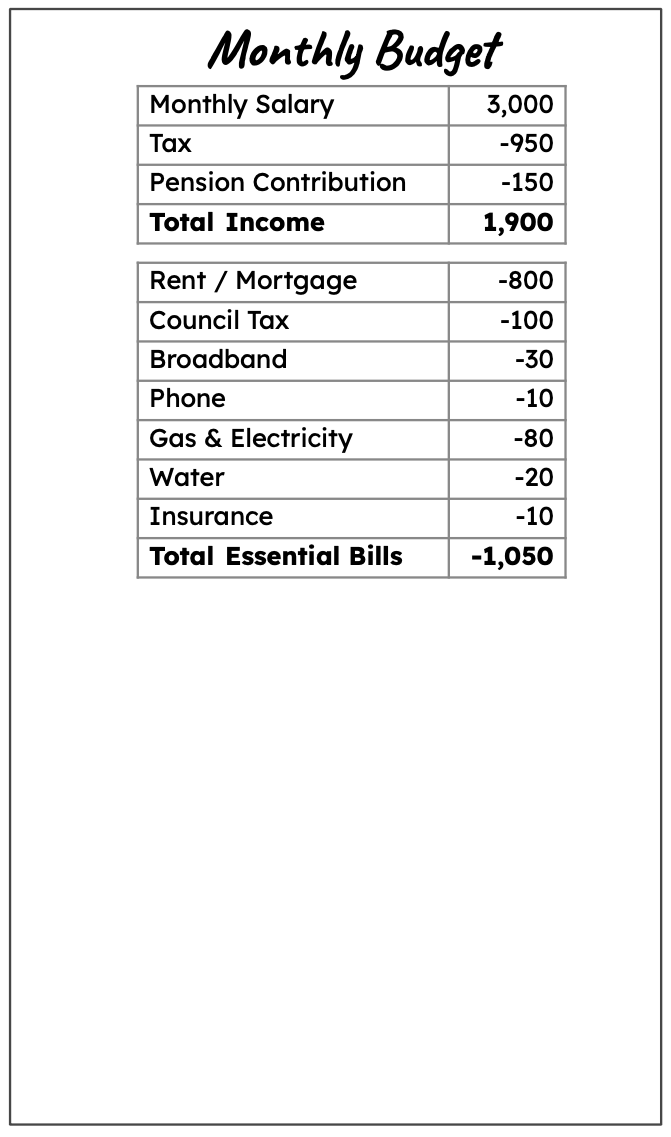

Once you know how much is coming in each month, the second step is to list out all your expenditure on essential bills. These are fixed costs that you can’t live without - they do not include discretionary items like clothes or entertainment. As a general guide, it should include:

Rent, mortgage payments, service charges, council tax

Gas, Electricity & Water Bills

Essential Insurance costs e.g car insurance (it’s illegal to drive a car on a public road without it!)

Ideally, these essential expenses should not exceed 50% of your monthly take-home income. If they do, it can be challenging to cover other financial priorities we'll discuss later. If your essential costs are higher than this, consider ways to reduce them, such as finding more affordable housing or renegotiating insurance contracts. That said, we understand that lowering these costs can be easier said than done, and it may not always be feasible depending on your circumstances. Nonetheless, it's a helpful goal to aim for when possible.

In the example, we’ve listed all of our essential bills totalling £1,050.

Add Your Essential Bills

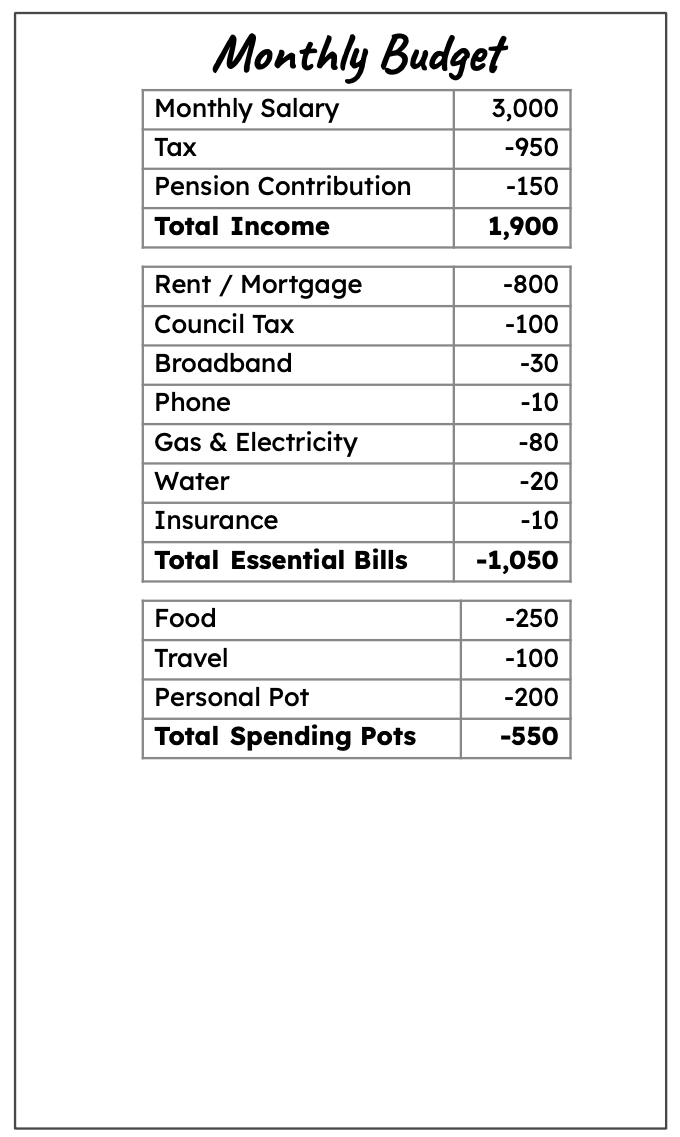

So far, we've calculated our monthly income and deducted our essential bills. The remaining amount is known as our monthly disposable income.

In the example provided, the monthly income is £1,900, and after subtracting essential bills of £1,050, the disposable income amounts to £850.

The next step is to decided what we’re going to spend this money on. We recommend dividing this disposable income into two main categories:

Spending Pots– These serve as budgets for discretionary expenses, including food, entertainment, travel, and other non-essential items.

Other Financial Goal Pots– These funds are allocated for paying down existing debt, saving, or investing for the future.

How you choose to distribute money into these pots is a personal decision and depends on your financial goals. Some people prefer to minimise discretionary spending and focus more on saving and investing. If you're unsure how to begin, a useful guideline is the 50/30/20 rule as we discuss in this article.

We’ll discuss both of these in the next two steps.

Add Spending Pots

Now its time to work out how much we’d like to spend on discretionary items by setting up some spending pots!

In our example, we have £850 of disposable income (£1,900 - £1,050 = £850). So we have decided £550 of this on spending pots.

When setting up your spending pots, you can choose between creating detailed budgets for specific categories—such as food, travel, entertainment, clothing, and phone bills—or you can opt for one general spending pot for all discretionary expenses. The choice depends on what works best for you.

In the example, we’ve created three distinct pots for discretionary spending:

A ‘Food Pot’ of £250

A ‘Travel Pot’ of £100

A ‘Personal Pot’ of £200 for everything else (e.g., entertainment, clothes, phone bills)

However, you can break these down into more specific categories if you prefer a more detailed approach.

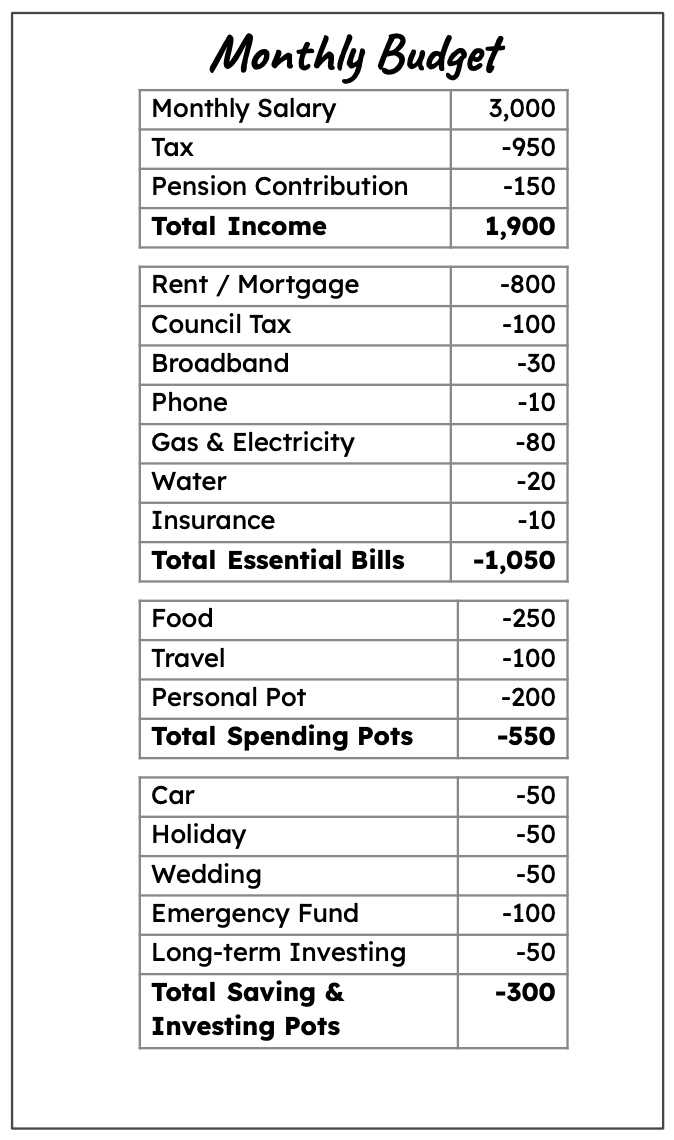

Add Other Financial Goal Pots

In addition to setting up monthly spending pots, it’s essential to allocate a portion of your disposable income towards other financial goals:

Debt Repayment (if you have outstanding debts)

If you're unfamiliar with these concepts, don't worry—we'll cover them in detail in upcoming lessons. You can always return to this section of your budget as you gain more understanding.

Your first priority should be debt repayment. As we’ll explain in the next lesson, certain types of debt, like a mortgage, can be manageable if they’re well-controlled. However, if you have a significant amount of high-interest or "bad" debt, it’s important to develop a plan to repay it. Focus on clearing these debts before setting up saving or investing pots. If your debt is overwhelming, aim to reduce your overall expenditure as much as possible to free up more cash for debt repayment. We'll explore this topic in more depth in the second money lesson.

Once your debts are under control, shift your attention to building savings and investing pots. Savings pots are for short-term goals, typically within the next five years, while investing pots are designed for long-term goals, such as retirement.

A key priority in your savings plan should be establishing an Emergency Fund. Additionally, consider creating specific savings pots for large, irregular expenses like car maintenance, holidays, weddings, or Christmas. These designated pots help you save for significant expenses that cannot be covered by a single month's income. We’ll dive deeper into these topics in the upcoming lessons.

As your financial priorities change, so should your savings and investing pots. Set target amounts for each pot, and once you reach those goals, consider redirecting funds to other priorities. If you withdraw from a pot, create a plan to replenish it over time.

In our example we’ve set up several pots for Car, Holiday, Wedding, Investing and an Emergency Fund totalling £300.

By setting up and maintaining these pots, you can take control of your finances, work towards long-term financial goals, and be prepared for unexpected expenses. While it may seem challenging at first, consistent effort will make managing these pots easier over time.

Check it Balances

You’ve almost built your budget, the final step is to check that it all adds up. Your monthly income, less essential items, less all the various pots you’ve created for discretionary spending and other financial goals should equal zero. If it doesn’t you’ll need to go back and adjust the different pits accordingly so it adds up to zero.

For example, if it’s negative 50. Then reduce one of you spending pots by 50 to bring the total balance to zero.

In our example, everything perfectly adds up to zero so we don’t need to adjust anything.

This is one of the most difficult steps as you may have to think hard what you can reduce if needed. There are lots of things you probably want to spend your money on, or save up for, but you can’t afford everything. So you need to allocate your money to the areas that are essential or you care most about.

If you really can’t reduce anything, and your budget is negative, then this is an issue that needs to be tackled as if its not resolved it could end up with you going into debt to cover all the costs. Could you earn more? Could you work overtime or get a second job to cover the expenditure needed? If you are struggling then its always important to speak to someone and get the help you need. Don’t put your head in the sand, get help.

Track Your Budget

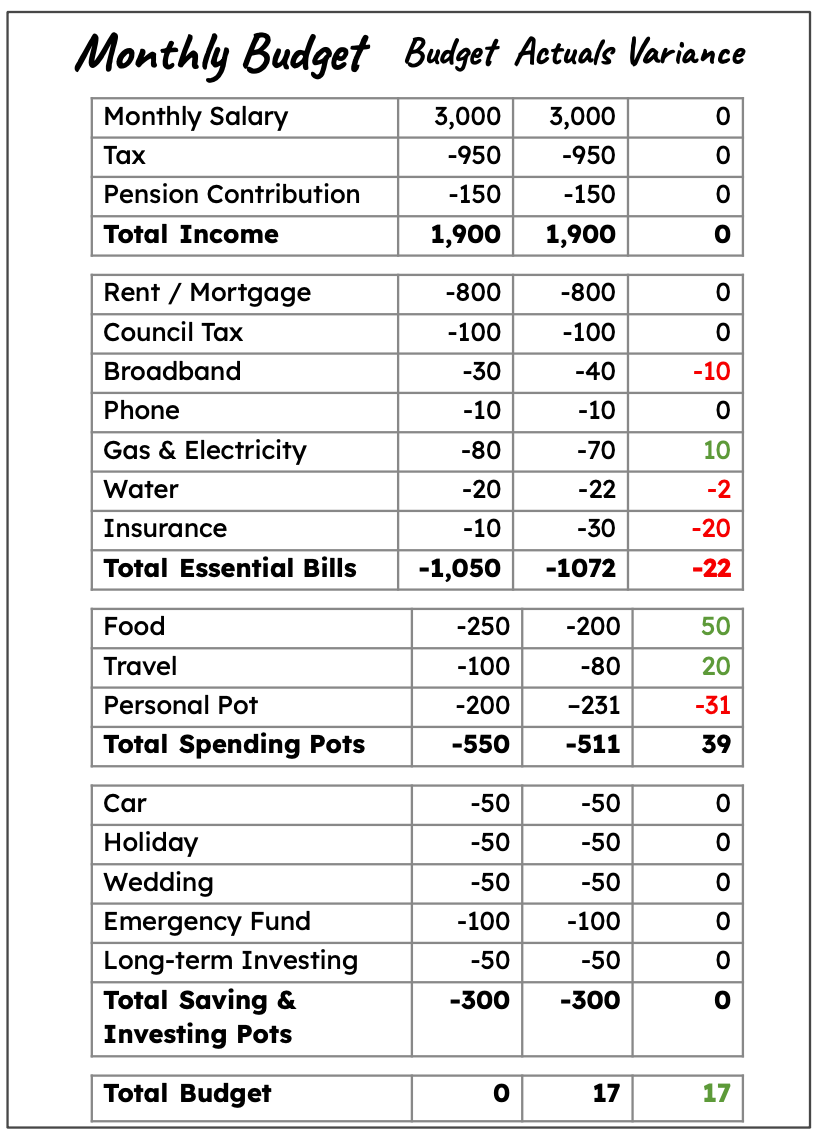

Now it’s all very well building a budget, but the most important thing is that you stick to it and its actually working. So each month, we would recommend that you monitor your income and expenses and check that you are keeping to the budget you set. Similarly each time you get a pay rise, or you know your expenses are going to change, it is important to revisit your budget and adjust it accordingly.

There are lots of ways that you can track your budget vs your expenditure. The most basic way is to set up a simple spreadsheet that lists out all of your income and expenses. It’s a bit more manual than other methods but it's simple and effective.

If you don’t like spreadsheets, or think it’s too manual, there are also lots of good apps and other technologies available which can help track your expenditure. Some of these connect to your bank automatically to view your transactions and then use artificial intelligence to automatically categories your spending into different categories which you can compare against you budget. This can be a quick and easy way to track your progress each month.

If you’ve set up your budget and started tracking your actual expenditure vs your budget monthly then well done! You’ve got a solid foundation to base your finances on.

Congratulations — you’ve just taken a big step toward taking control of your finances!

By learning how to build a budget, you’ve created the foundation for making smarter money decisions, staying organised, and reaching your financial goals. Now that your spending is under control, you're ready for the next money lesson: how to manage debt wisely and confidently.